Unggulan

- Dapatkan link

- X

- Aplikasi Lainnya

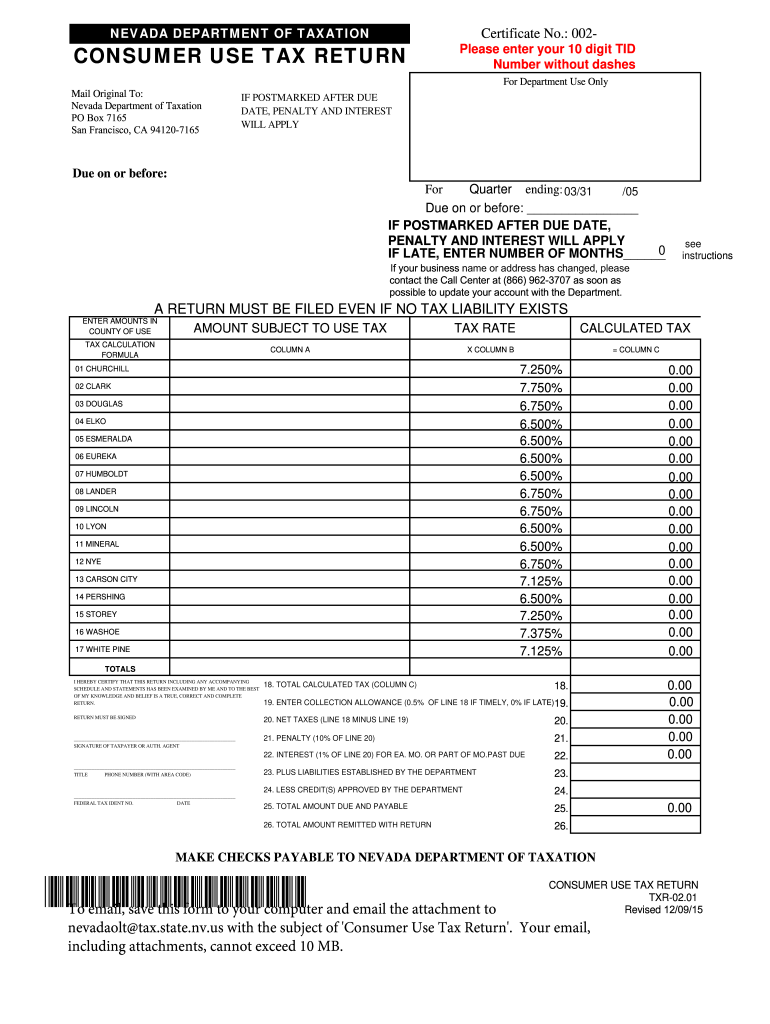

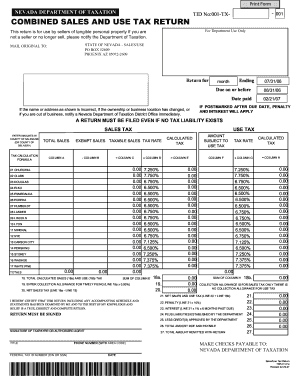

Blank Nv Sales And Use Tax Form - Nevada Sales and Use Tax Close out Form Download Fillable ... / Firefox users will need to change their portable document format to allow the use of adobe acrobat reader.

Blank Nv Sales And Use Tax Form - Nevada Sales and Use Tax Close out Form Download Fillable ... / Firefox users will need to change their portable document format to allow the use of adobe acrobat reader.. Get free nv sales now and use nv sales immediately to get % off or $ off or free shipping. If you will be filing your return late, you may qualify for an extension. The prepayment form should be filed even if you have no tax to report. Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer. Check this page regularly for updates to the above states.

The sales tax rate is 6%. Vermont use tax is taxpayers may file returns and pay tax due for sales and use tax using myvtax, our free, secure, online filing site. Firefox users will need to change their portable document format to allow the use of adobe acrobat reader. Consumers use tax | all about tax compliance. Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer.

Heavy highway vehicle use tax return used to figure and pay the tax due on highway motor vehicles, figure and pay other vehicle taxes request for transcript of tax return use this form to order a transcript or other return information free of charge, or designate a third party to receive the information.

Official irs income tax forms are printable and can be downloaded for free. They include graphics, fillable form fields, scripts and functionality that work best with the free adobe reader. Here is a list of the most common customer questions. Enter sales tax reimbursement or use tax collected from customers if those taxes were included in the amount shown on line 1 (see regulation 1700). Sales and use tax exemption. This form is read only, meaning you cannot print or file it. If you can't find an answer to your question, please don't hesitate to. Nebraska sales and use tax statement for motorboat sales note: Tax forms have changed for 2020. Form used by consumers to report and pay the use tax on taxable tangible goods and alcoholic beverages that were purchased tax free out of state and are used in maryland and. Heavy highway vehicle use tax return used to figure and pay the tax due on highway motor vehicles, figure and pay other vehicle taxes request for transcript of tax return use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. Sales tax forms used for department of motor vehicle transactions; 7.25% sales and use tax rate cards.

Sales and use tax final return form. Here is a list of the most common customer questions. Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer. The current list of states we collect sales tax in are: If you can't find an answer to your question, please don't hesitate to.

Some sales and use tax forms now contain a 1d barcode.

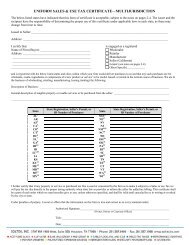

Heavy highway vehicle use tax return used to figure and pay the tax due on highway motor vehicles, figure and pay other vehicle taxes request for transcript of tax return use this form to order a transcript or other return information free of charge, or designate a third party to receive the information. Official irs income tax forms are printable and can be downloaded for free. Consumers use tax | all about tax compliance. The prepayment form should be filed even if you have no tax to report. Vermont sales tax is charged on the retail sales of tangible personal property unless exempted by law. Sales tax forms used for department of motor vehicle transactions; Please use internet explorer to get the best results when downloading a form. Streamlined sales and use tax agreement certificate of exemption. Do not use this form if you have tax recovery deductions such as bad debts on taxable sales, returned taxable merchandise, cash discounts on. Form used by business owners who have sold or discontinued their business. Nebraska sales and use tax statement for motorboat sales note: For casual sales, the sales/use tax is due before registering or by the twentieth day of the following month, whichever occurs earlier. Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer.

Please visit the filing and state tax section of our website for more information on taxpayers may only file paper forms if the electronic filing requirement creates a hardship upon the taxpayer. If your business is registered as a retail sales tax dealer with us, you can use the virginia sales and use tax dealer lookup through your online business account to verify that a business. Vermont sales tax is charged on the retail sales of tangible personal property unless exempted by law. Sales tax collection rules and requirements also vary state to state. How to file a texas sales tax return.

The issuer and the recipient have the responsibility of determining the proper use of this certificate.

If you are tired of filling out tax returns yourself or paying a bundle to have others go through your tax forms, you can experience the ease and convenience of free income tax. Effective january 1, 2020 the clark county sales and use tax rate. The current list of states we collect sales tax in are: Please use internet explorer to get the best results when downloading a form. Get free nv sales now and use nv sales immediately to get % off or $ off or free shipping. If you are exempt from sales tax and live in one of the above states, you. District of columbia sales and use tax forms. Enter sales tax reimbursement or use tax collected from customers if those taxes were included in the amount shown on line 1 (see regulation 1700). Click here for aviation fuel sales & use tax forms. While other browsers and viewers may open these files, they may not function as intended unless you download and install the latest version of adobe reader. Vermont sales tax is charged on the retail sales of tangible personal property unless exempted by law. Sales tax applies to most retail sales of goods and some services in minnesota. This form is read only, meaning you cannot print or file it.

- Dapatkan link

- X

- Aplikasi Lainnya

Postingan Populer

Tomboys Hair Dark Black Portraits / tomboygermany: Happy days im-so-confused-right-now | Hair ... : Media shared can be nsfw, but the info/links.

- Dapatkan link

- X

- Aplikasi Lainnya

Nestle Araçatuba / Nestlé investirá R$ 1 bilhão nas fábricas de Araçatuba e ... - Nestlé araçatuba is one of the popular local business located in rod.mal rondon ,araçatuba listed under local business in araçatuba , commercial & industrial in araçatuba

- Dapatkan link

- X

- Aplikasi Lainnya

Komentar

Posting Komentar